How to Write a Check in 5 Easy Steps

Checks are not obsolete yet; however, many people do not know how to write a check out correctly. I occasionally cringe when I see checks my clients receive and wonder how the bank decided to honor it. For those who fill out checks regularly, the process becomes almost automatic. However, if you haven’t written many checks, it can be pretty unclear. Electronic transfers are superseding checks, but they aren’t obsolete yet.

Here are the steps needed to correctly fill out a check and explain the numbers preprinted on each one.

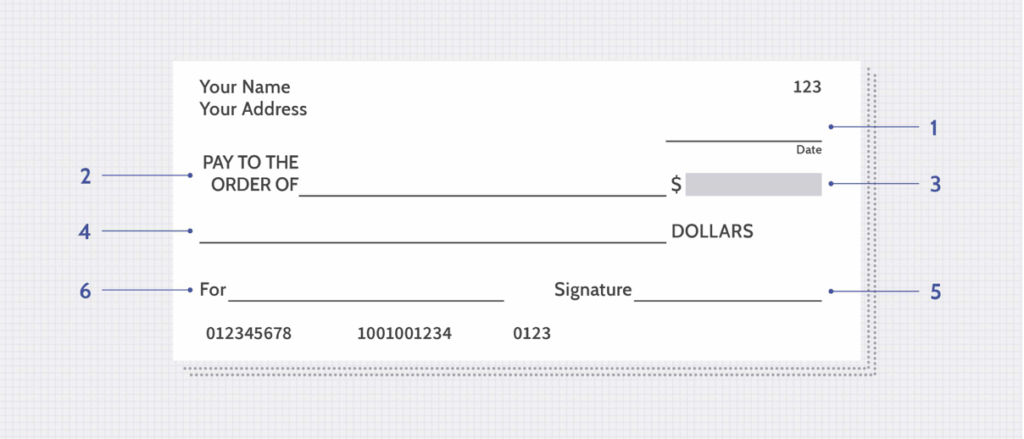

Example of How to Write a Check

-

Date—Fill in the date on the blank line at the top right corner of the check. The month/day/year format is standard for the United States.

-

Recipient’s Name—Write the recipient’s name on the blank line after the phrase “Pay to the Order Of.” This can be an individual, an organization, or a business—whomever the check is going to. For an individual, be sure to include the first and last name. For an organization or business, use its full name.

-

Amount (Numerical Form)—In the box to the right of the recipient’s name, fill in the amount in dollars and cents using numbers.

-

Amount (Expanded Word Form)—The dollar amount should also be written in expanded word form on the blank line below the recipient’s name. Cents, however, should be written in fraction form.

-

Signature—Sign your name on the line at the bottom right corner of the check. Your signature is mandatory—the recipient will not be able to cash the check without it.

-

Memo (Optional)—At the lower left is a line where you can, if you choose, note what the check is for, or write in your account number for, say, the utility company you’re paying with that check. It can also indicate that the recipient should apply the money to what you owe and not some other item. For example, if you are using the check to pay for something at your child’s school, you could write your child’s name and grade in the memo line.

Routing Numbers, Account Numbers, and Check Numbers

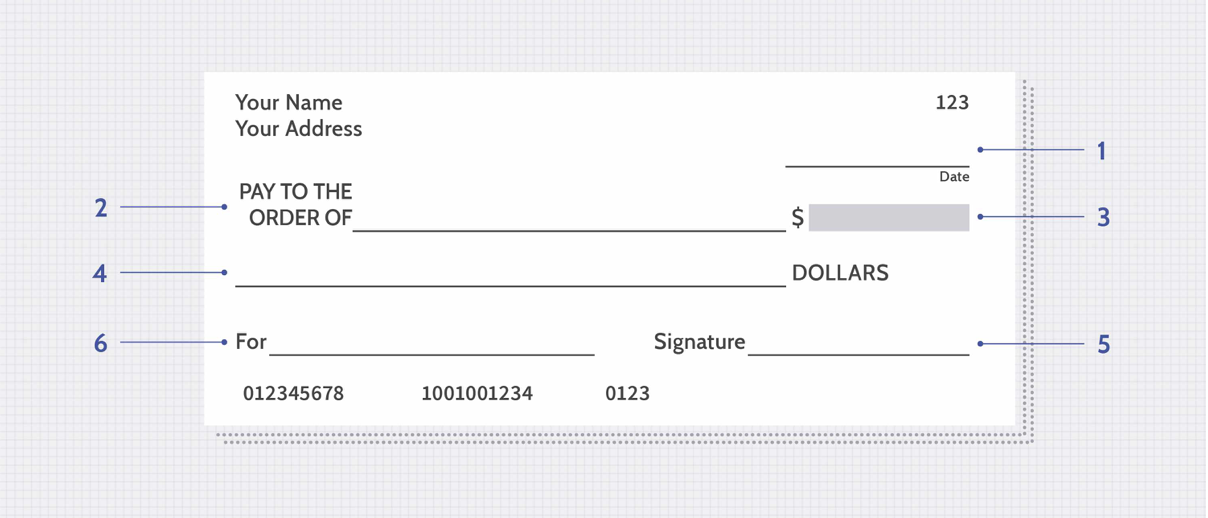

The numbers running across the bottom of the check represent the following:

- Routing Transit Number—The first sequence of numbers represents your financial institution’s routing transit number. This code identifies your bank, allowing the check to be directed to the right place for processing.

- Account Number—The second sequence of numbers is your unique account number, and it was assigned by the bank when you opened the checking account.

- Check Number—The last sequence of numbers is the check number. It is also featured at the top of the check, beneath the date, and it helps you track the payment later if needed.

The Bottom Line

While the ability to pay online from a checking account has dramatically reduced the need to how to write a check, there are still times when one is needed, so it is essential to know how to fill it out correctly.